GST Council the discussion was taken of GST new tax structure for real estate industry of 33rd GST Council meeting dated 24.02.2019

The ongoing projects will have an one-time option to continue under old scheme with ITC or switch over to new one without ITC. The time limit for transition will be discussed with states. However, reversal of ITC will have to be done in proportion to area or space.

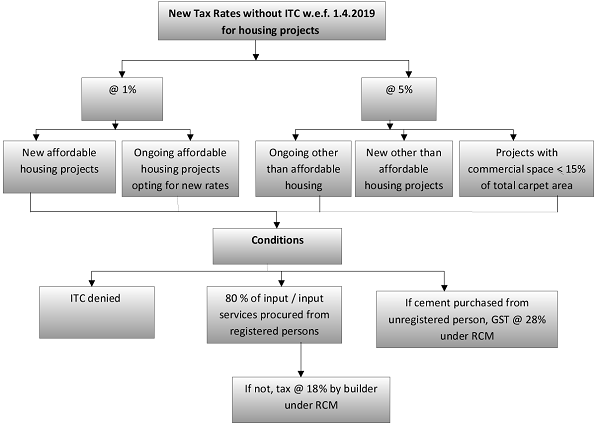

In the new scheme, 80% of the materials shall be procured from registered dealers except for capital goods, development rights, leases premium etc.

This is a stringent condition as on shortfall of purchases from 80%, builders shall be liable to pay GST @ 18% under reverse charge mechanism.

In case of cement purchased from unregistered supplier, GST shall be levied @ 28% under reverse charge method.

What would be the GST rate on commercial apartments in case they are constructed in a residential real estate project?

5% without ITC if carpet area of commercial apartments is not more than 15% of total carpet area of the residential project. In all other cases GST rate on commercial apartments shall be 18% (effective rate 12%)

Example : The residential project total square feet 1000 so the builder develop the commercial apartments not more than 15% of carper area (i.e. 150 Square feet is constructed commercial apartment GST tax levied on 5% without ITC.

Relief has also been granted to commercial apartments (shops, offices etc) in any residential project for lower GST rate of 5% where carpet area of such commercial space is not more than 15% of the total carpet area of all apartments.

In case of Transfer of development rights, FSI and long term lease premium, burden of GST has been shifted to builder under reverse charge with time of supply to be determined on the basis of date of issue of completion certificate.

The same time of supply would apply to JDA’s. In case of input tax credit, ITC rules shall be amended to have clarity and provide procedure for monthly and final determination of ITC and its reversal for real estate projects.

Salient features of decisions taken by the GST Council in the 34th meeting held on 19th March, 2019

Option for under construction projects

- Under Construction projects as on 31st March, 2019 shall have an option to choose old rates (effective rate of 8% or 12% with ITC) with input tax credit or new rates without input tax credit.

- If the option is not exercised within the prescribed time limit then new rates shall apply.

Conditions for the new tax rates:

- Atleast 80% of the material to be procured from registered dealers. Further, on shortfall of purchases from 80%, tax shall be paid by the builder @ 18% on RCM basis.

- However, Tax on cement purchased from unregistered person shall be paid @ 28% under RCM, and on capital goods under RCM at applicable rates.

- Input tax credit shall not be available.

The new tax rates which shall be applicable as follows:

1% without input tax credit (ITC) on construction of affordable houses shall be available for:

- Houses having area of 60 sqm in non- metros / 90 sqm in metros and value upto RS. 45 lakh

- Under construction affordable houses presently eligible for concessional rate of 8% GST (after 1/3rdland abatement)

5% without input tax credit shall be applicable on construction of:

- Under construction houses other than affordable houses presently booked prior to or after 01.04.2019.

- For houses booked prior to 01.04.2019, new rate shall be available on instalments payable on or after 01.04.2019.

- Commercial apartments having carpet area of not more than 15% of total carpet area of all apartments.

Transition for ongoing projects opting for the new tax rate:

- Ongoing projects not been completed by 31.03.2019 shall transition the ITC in proportion to booking of the flat and invoicing done for the booked flat is available subject to a few safeguards.

- For mixed project transition of ITC shall be allowed on pro-rata basis in proportion to carpet area of the commercial portion

- Treatment of TDR/ FSI and Long term lease for projects commencing after 01.04.2019

- Supply of TDR, FSI, long term lease (premium) of land by a landowner to a developer shall be exempted with the condition constructed flats are sold before issuance of completion certificate and tax is paid on them.

- Exemption can be withdrawn (limited to 1% of value in case of affordable houses and 5% of value in case of other than affordable houses) if flats sold after issue of completion certificate.

- Builder shall be liable to pay tax on TDR, FSI, long term lease (premium) on the date of date of issue of completion certificate.

No comments:

Post a Comment